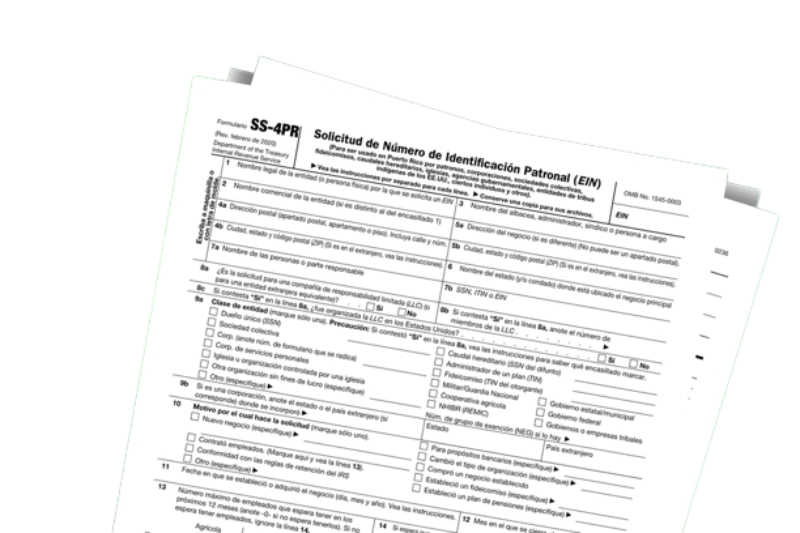

Ein number is also known as Employer Identification Number. It is issued by the Internal Revenue Service, the IRS. A unique identifier assigned to the business entity. Employers use it to report their taxes.

To get this nine-digit number, simply apply to the IRS. After submitting the required documents, you just have to wait for the result to come out.

However, this can cover a very long process. If you want to reach the solutions you are looking for as soon as possible, ein-itin offers you the best solutions for your EIN number. If you get in touch, you can both ask your questions about the process and get help in the process.

An EIN number is required if you are employed in the United States, filing tax returns, or withholding taxes from income other than wages. Organizations that provide commercial services should apply for this by telephone, fax, mail or fax before starting. All business types can apply for it, including;

- Limited Liability Companies

- Sole Proprietorships

- Non-Profit Organizations

- Government Agency

- S Corporations

- Partnerships

- Estates

The application for an EIN number is therefore essential.

Is it Necessary to Get an EIN Number?

The IRS requires some firms to obtain an EIN number for their reporting requirements. In this respect, a company should make the necessary applications in the following cases;

- Any employee

- Operating as a firm or partnership

- File tobacco, firearms, employment, excise or alcohol tax returns.

- Withholding tax on income paid to non-resident foreigners

- Keogh’s plan

In such cases, the necessary EIN online application should be made to obtain an EIN number. Ein is unique to the businesses it is assigned to. In this respect, even if the original employer becomes unemployed, it is not reassigned to a different enterprise.

Apart from this, it also brings the advantage of working. Since works cannot be carried out without an EIN number, it must be applied and received first.

What Can Be Done With Ein?

The ein number allows you to recruit and pay employees. It allows you to open a bank account, get loans and invest excess cash.

Allowing the protection of corporate shields, the ein number also enables the filing of business taxes. It also allows state taxes to be recorded. In addition, the ein number allows you to keep your personal finances separate from your business. With ein-itin, you can get it very easy.