Any contractor who is serious and professional in their work must have adequate insurance. This insurance should cover all aspects of the business, including people and equipment. Proper policies provide protection to workers, clients, and everyone involved in the contractor’s business in some way. But first of all, it protects the company from liability in case of unforeseen circumstances and high out-of-pocket expenses.

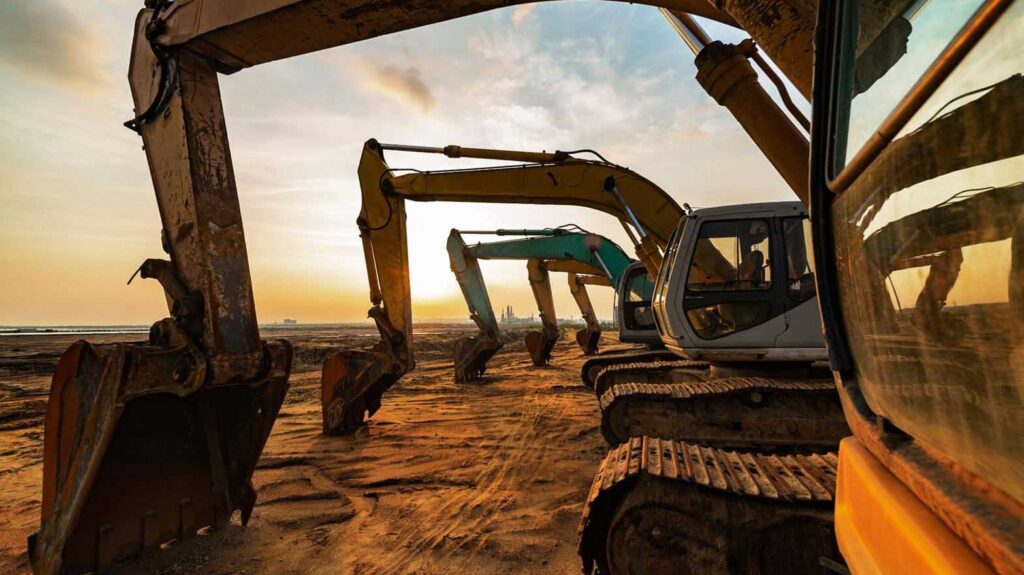

The machines and tools used by contractors in the construction industry are highly valuable. They constitute the most significant investment for any company involved in construction projects because they are basic work tools. Without them, no trading would be possible, which can be detrimental to any business.

Costly construction tools and machines are highly susceptible to theft. There are many reasons for this, and one of the main factors being the existence of the black market for heavy machinery worth billions of dollars. In addition, most construction sites are poorly secured, making valuable equipment easily accessible to thieves.

If your business depends on heavy equipment and tools, you want to prevent even the slightest risk that could endanger your operations. There are different types of insurance for any business aspect. But you should pay special attention to protecting your work equipment, so make sure to consider options for the best coverage in case of theft. You can find more information at https://fastmachineryinsurance.com.au/.

Does Your Business Need Equipment Coverage?

If you work in any trade that relies heavily on plant equipment, protecting it is out of the question. Regardless of the industry you work in, whether it’s mining, construction, energy, or any other field, you surely have valuable machines in your possession. For example, general contractors may own excavators, loaders, backhoes, and more. For roofers, these can be all kinds of cranes, forklifts, etc.

All the machinery mentioned above is only part of the plant machinery, which should be secured properly. Of course, these machines should have a high level of coverage, given that they are expensive equipment vital for your business. The same rules apply whether you own or rent these machines from third parties for your business needs.

If you have expensive machinery, it can be stolen anywhere. This can happen inside your plant, on the construction site, and even during the transportation of your work equipment. So you might want to improve the security of the construction site by following guidelines from this website. Still, nothing can beat the importance of a proper insurance policy.

When you look for the best coverage for your heavy equipment, it has to be comprehensive. All terms of the policy must be clearly stated in the contract, so you know how much coverage you have (coverage limit) and under which conditions.

How to Choose Plant Equipment Policy

When your business relies on tools and machines, you should always know what you have at your disposal. To start, make a list of all the pieces of equipment that are crucial to your business. That way, you can see which machines you need to secure.

Keep in mind that the number of thefts of plant machinery has been on the rise in recent years, as used working machines are in high demand. It’s always better to be safe than sorry if you own valuable equipment on which your business actually depends.

Also, the industry you work in will affect the choice of insurance policy, and under which conditions. The insurer will evaluate all posed risks before coming out with an offer. Another thing that can make a difference is whether the machinery you work with is owned or rented. Some companies combine insurance for hired-in and rented equipment, which is always a better solution as it costs less than purchasing separate policies.

When looking for proper insurance, your first stop should be your current insurer. If you already have business insurance, discuss options regarding extending policy coverage to your heavy machinery. Of course, keep in mind that you’re not obliged to choose the current insurer if the conditions of the new policy don’t suit you or the premiums are too high. Instead, you’re free to shop around.

Choose Insurer

Considering the large number of insurance companies operating on the market, researching the offer of each of them can be quite time-consuming. If that seems like a lot of work, you can leave that task to a dealer or a broker, who will find the most favorable offers that match your needs and possibilities.

For starters, look for insurers with sound industry experience. As it’s a matter of ensuring your valuable assets, it’s of great importance to work with trustworthy insurance companies. So read reviews and check testimonials from previous clients. These can be helpful sources of information you can’t find on the insurer’s website.

When checking the insurer’s offer, look for those who provide comprehensive insurance that includes all the risks. For instance, burglars can cause significant damage to your property while stealing your backhoe. What’s more, someone might get hurt if they happen to be near the crime scene. With a comprehensive policy, you protect yourself, your property, assets, and third parties.

Know What’s Excluded from Plant Machinery Insurance

Before signing anything, all contract details must be transparent. This refers to policy excesses and things that are excluded from it. The latter can vary from insurer to insurer.

Some insurers may have conditions that only machines less than five years old are covered by the policy, while others may set limits on the value of the equipment, they provide coverage for. In any case, it is important to have a complete understanding of these terms.

In case the damage from theft exceeds the policy limit, you pay the excess. Or you can agree with the insurer that you pay a certain amount to make up your loss. That way, you cover a portion of the damage, and that amount is pre-agreed and stated in the contract. The rest of the claim is on the insurer.

The higher the excess, the lower your premium is. It’s just one way to lower insurance policy costs. You can also cut these costs by making your plant or construction site safer. One of the solutions is to put up a fence, at least a temporary one, add video surveillance, or install a security alarm system.

Is Theft Insurance Worth It?

Whether you run a small business or a contracting company, insuring your machinery is an absolute must. As these are all expensive machines and tools, buying them represents a significant investment. When you have already invested a lot of money, you want to ensure that your investment pays off over time.

In case of theft, significant downtime can occur in your work. It can affect the current projects you are working on, and it can certainly prevent you from securing new contracts. This means that in addition to the costs of purchasing new equipment, you may also face loss of profit and possible problems with clients, who may even sue you.

Check the following page to learn more about ways to reduce downtime on projects you’re working on: https://www.forconstructionpros.com/profit-matters/blog/22392517/caterpillar-cat-6-steps-to-stop-downtime.

Having proper insurance has your back. In case of theft, your insurer will compensate for your loss, as that’s the purpose of the policy you pay for. This can provide you with peace of mind, as it helps you avoid the high costs of buying expensive machinery all over again. So, this unwanted situation will not affect your business.

Having proper plant machinery insurance is always a good investment. In a large number of cases, you may never need it. Still, in the case of malicious activities, such as the theft of a valuable machine, you’ll be very glad to have it. This policy helps you claim any stolen piece of equipment, saving you high out-of-pocket costs and preserving your business reputation.