Many people, including myself, used to keep track of business mileage in notebooks, on pieces of paper, or even on fast food napkins. After keeping the Mileage tracker app, you may have used the calculator on your watch to determine the distance travelled between your starting and ending positions. Fortunately, technology has provided us with tools that simplify mileage monitoring, expense reporting, and fleet management.

Using Mileage Monitoring Software Has These Advantages:

1. Make it available on mobile devices:

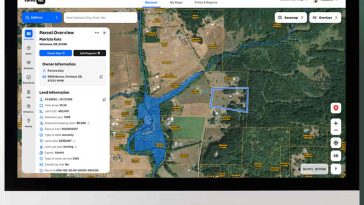

There are numerous advantages to using a Mileage tracker app. You’ll be relieved that you can get these apps for your phone and use them whenever you like. Because of this, you’ll have a considerably easier time managing the fleet and keeping track of how much gas each vehicle has consumed. The ability to monitor your fleet from anywhere is another perk. You can see where the cars are at all times, even when they are at home or being packed. This up-to-the-minute data is invaluable for running your company.

2. They eliminate the uncertainty:

Using a Mileage tracker app can provide peace of mind for those who need to keep tabs on their work travels. You’ll have confidence that the app will help you keep track of relevant information that will feed into reports that align with IRS requirements. These apps will keep track of your mileage for you, and you can choose whether to file it under a business or personal use. These apps will provide the necessary reassurance for those who wish to refrain from spending significant effort monitoring and logging their mileage.

3. Allows you to rest easy:

A Mileage tracker app will let you rest easy and focus on what matters to your company. For example, if you work in sales, the app can keep track of your miles so you can devote more time to servicing your clients. You won’t need to keep track of your mileage by hand.

4. It boosts output:

You’ll get more done if you devote less mental energy to mindless chores like keeping track of your mileage and similar activities. For instance, a real estate agent will have additional time to focus on advertising their services and guiding potential buyers on tours of available properties. Refrain from discounting how much time you will save by using this software.

5. Useful for keeping financial records:

The mileage monitoring app’s precision in recording travel distances is a major benefit. If you’re an accountant, you can help your clients save money on taxes by using a Mileage tracker app. It can also be useful when one has to keep track of the money spent on their car.

6. Automatic:

Automatic tracking is a feature provided by some mileage monitors. Some answers can be implemented without using a mobile app or hardware gadget to monitor mileage. As soon as the app recognizes the user is behind the wheel, automatic mileage monitoring will begin. They can do this even if the tracking app is closed. This eliminates the possibility of anyone failing to report business-related mileage. If you or your staff need help to remember to log business miles, this is a huge perk.

7. Convenient:

Keeping tabs on miles via an app or other software is much more convenient. Your mileage log is accessible online 24/7 from any device. You can run your business completely paperlessly without touching a paper or picking up a pen. A smartphone app is all that’s required. Convenience is the pinnacle of luxury for business owners and operators. You can do this and much more with the help of mileage-tracking applications.

Employers frequently cover the cost of employees’ legitimate business costs. For tax purposes, this is the best option for everyone. However, you can only do that if you’re prepared to keep track of your mileage. Thankfully, Mileage tracker makes it simple to keep tabs on your travels. As stated above, there are numerous benefits to employing mileage-tracking technology. When determining whether or not to use automatic Best Mileage tracker app monitoring and other forms of expense tracking, it’s important to keep these benefits in mind.

8. Compliance:

Using software to keep track of employee mileage might help your company stay in tax compliance. You must know this information if you or your workers want to take the usual mileage deduction on your annual tax returns. It’s important to follow all IRS regulations. Otherwise, an audit can catch your carelessness and make you pay for it afterwards. Using mileage monitoring software is a great way to guarantee that your company is always by IRS tax regulations.

9. Accuracy:

The accuracy of Mileage tracker is superior to that of manual approaches. People make mistakes. There is no denying this. Even the most honest person can make a mistake when recording mileage. This won’t be a problem, thanks to mileage tracking apps. All mileage data you receive is guaranteed to be correct. Better accuracy in filing taxes is always a plus, and this will help achieve that. The precision of mileage-tracking apps is unparalleled.

Conclusion:

Apps are available to help your staff avoid potential dangers on the road, such as traffic jams, accidents, and severe weather. The fleet’s speed may be monitored, too, so you’ll know if any drivers are speeding or otherwise being hazardous.