Every year reputable resources, such as Forbes, report on new emerging Fintech companies around the world, making this market niche even more competitive. If you’ve just launched your financial technology venture or planning to do so, you already need to start thinking about ways to help your business stand out. One of them is investing in enterprise mobile app development.

If you’re interested in this solution, you must be asking yourself – what should you be looking for in a vendor to outsource software development to?

We recommend paying attention to the following characteristics.

1. A Selection of Case Studies for Similar Businesses

Understandably, a good software development company should offer the services of experienced professionals with years of experience – we don’t need to discuss that.

What is, in fact, important is that a given vendor has already worked on projects similar to yours.

How can you find this out?

The most obvious way is, of course, word-of-mouth. However, you can always go to the vendor’s website and check out the Case Studies section – it should include examples of companies like yours that have already outsourced software development to a given agency and seen results.

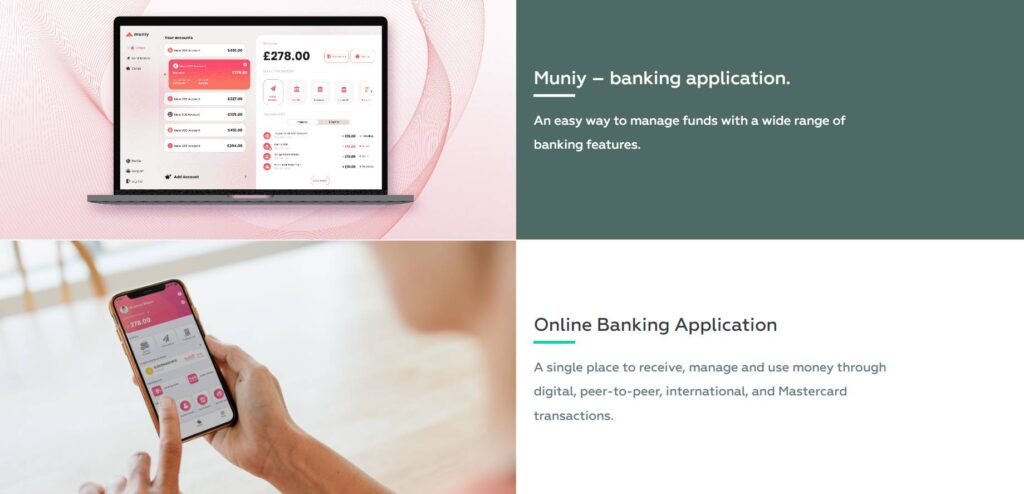

Examples of fintech software development case studies from the docode.dev website

This example from doCode showcases some case studies with a brief description of software along with its most prominent features. When you click on it, you can also read what a company managed to achieve with the app developed by the vendor and what core app features were created.

Ultimately, this information serves as a portfolio that confirms (or doesn’t confirm) that a given software development agency is worth your investment.

2. Appropriate Risk Management Practices

It’s not a secret that fintech software will be dealing with high volumes of sensitive customer data. Thus, when looking for a software development company, you need to learn everything you can about its risk management methodology.

This methodology should ideally cover the following aspects:

- Business risks – can arise from the company’s business operations.

- Operational risks – happen when the company doesn’t set clear software development goals.

- Technical risks – occur because of flawed app architecture, etc.

A good fintech software development company should have mechanisms in place that would help mitigate these problems and evaluate the likelihood of potential risks and their impact on your collaboration.

Finally, it is a good sign if a company offers to create a risk management plan for your software development project with effective preventive measures

3. Cybersecurity

Finally, we can’t underestimate the importance of cybersecurity in fintech software development. Here, the underlying reason is the same as with risk management – sensitive customer data.

Obviously, if a vendor doesn’t pay enough attention to maximizing the cybersecurity of your software, you can incur many losses, which can cost you your business. So, the more details you can learn about the cybersecurity measures of your vendor, the better.

For instance, you can ask them what practices for secure coding software their developers use, whether they apply machine learning to prevent cyber attacks on sensitive information, and overall, which security frameworks the company follows.

Over to You

Indeed, there are quite a few fintech software development companies to which you can outsource your project. However, not all of them are born equal, and it’s very easy to fall victim to a shady vendor.

Thus, before you blindly trust an agency, make sure to check out their portfolio and study their approaches to risk management and cybersecurity. Go on a demo call to see what they are all about and ask as many questions as you can – after all, the reputation of your business is at stake.