Cathie Wood’s ARK Innovation ETF has taken another hit in the U.S. stock market selloff on Wednesday, with the technology sector taking a hit due to fears that the Federal Reserve would become more hawkish in its fight against rising inflation.

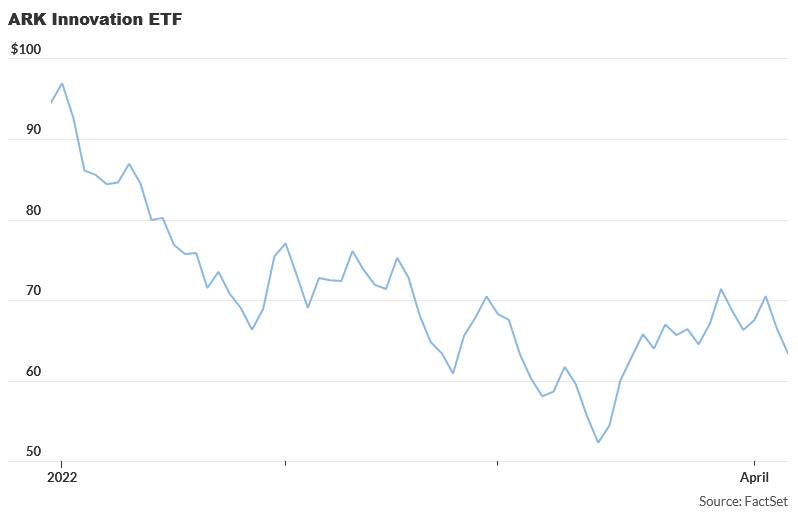

According to FactSet data, shares of the ARK Innovation ETF ARKK, -4.63 percent, an exchange-traded fund managed by Ark Investment Management founder Wood, were down approximately 5% Wednesday afternoon. The ETF, which aims to invest in shares of firms that would gain from “disruptive innovation,” has lost approximately 33% this year after also falling in Tuesday’s stock market slide.

Investors were concerned about the prospect of rising interest rates as the Fed becomes more forceful in combating the highest inflation in 40 years, as all three major U.S. stock benchmarks were trading lower Wednesday afternoon, with the tech-heavy Nasdaq Composite COMP, -2.22 percent seeing the biggest losses. High-growth and technology equities are commonly thought to be more susceptible to increasing interest rates.

According to FactSet statistics, the Nasdaq was down nearly 1.6 percent Wednesday afternoon, while the S&P 500 SPX was down 0.7 percent and the Dow Jones Industrial Average DJIA was down 0.2 percent. Information technology (XX:SP500EW.45) was one of the worst-performing sectors in the S&P 500, falling roughly 1.8 percent.

Investors evaluated words from Fed Governor Lael Brainard, who said the Fed may begin rapidly lowering its balance sheet as early as its next meeting in May, as all three benchmarks closed down Tuesday, with the Nasdaq leading the way below.

The central bank would tighten monetary policy by reducing its roughly $9 trillion balance sheet and raising interest rates. Officials at the Fed’s March meeting agreed to lower the balance sheet by $95 billion each month following a three-month phase-in, according to minutes released Wednesday. Many Fed officials may favor rate hikes of 50 basis points at forthcoming sessions, according to the minutes, if inflation remains high or rises.

Treasury rates rose on Wednesday as investors awaited the release of the Federal Reserve’s meeting minutes.

According to FactSet data, the 10-year Treasury note yield TMUBMUSD10Y, 2.579 percent, was trading near 2.6 percent Wednesday afternoon. According to Dow Jones Market Data, the yield on the 10-year Treasury note surged to 2.554 percent on Tuesday, the highest since April 23, 2019, based on 3pm Eastern Time levels.

The Goldman Sachs Future Tech Leaders Equity ETF GTEK, -3.32 percent was also down Wednesday afternoon, though its decline of approximately 3% was less severe than the ARK Innovation ETF’s losses, according to FactSet data at last check. According to FactSet statistics, the ARK Innovation ETF is continuing its downward trend from Tuesday, when it plummeted 5.7 percent.