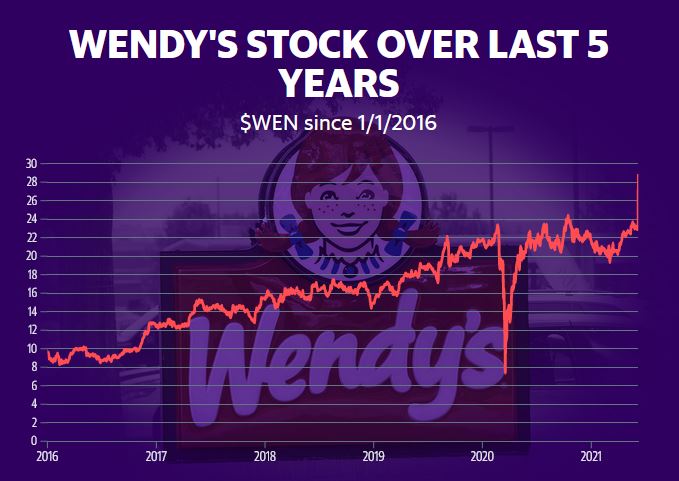

Wendy’s (WEN), the beloved burger and Frosty business, is the first fast-food stock to be ensnared into the red-hot meme stock trade.

Wendy’s stock jumped 16 percent in early afternoon trading on Tuesday after traders on Reddit praised the company. The Wendy’s ticker page was the second most popular on the Yahoo Finance platform, behind Clover Health, another popular parody (whose stock popped 55 percent out of nowhere). Wendy’s stock beat a 6% surge in the OG of meme trading, GameStop, as well as a minor fall in meme stock darling AMC Entertainment (which reports earnings on Wednesday).

A Wendy’s spokesman told Yahoo Finance, “We’re aware of the odd trading activity this morning and we’re closely monitoring.”

There are at least two things that stand out about Wendy’s stock’s unexpected move on Tuesday.

According to Yahoo Finance Plus statistics, only 4.64 percent of the company’s outstanding shares are sold short or have undergone short selling. This is in contrast to the high short position equities that have defined the global stock market this year. To put it another way, unlike GameStop and AMC, Wall Street is not betting against Wendy’s future.

This leads us to the second point. Unlike other meme stocks, Wendy’s is a fundamentally sound and expanding business, which is why Wall Street doesn’t despise it.

Wendy’s same-store sales in the United States increased 13.5 percent in the first quarter, owing to guests returning after receiving their COVID-19 vaccine and testing the chain’s new morning menu. First-quarter revenues were also boosted by digital ordering and a push into more premium chicken sandwiches.

Wendy’s same-store sales increased by 7.9% globally.

The Dave Thomas creation nearly outperformed McDonald’s U.S.’s 13.6 percent same-store sales rise in the quarter, which could be considered as a disappointment given the company’s recent rollout of three new chicken sandwiches. Burger King’s same-store sales increased by 6.6 percent in the third quarter in the United States.

For good measure, the U.S. businesses of Domino’s Pizza and Pizza Hut increased same-store sales by 13.4% and 16%, respectively, in the first quarter.

Additionally, as the economy roars back to life, Wendy’s CEO Todd Penegor expects the breakfast sector to be a big tailwind for the company this year.

Penegor recently told Yahoo Finance Presents, “We’re really optimistic about where this company [breakfast] may go in the future and as part of our profitability, Because we do believe it can be a 10% mix of our business by the end of 2022.” “We’ve been discussing how [breakfast] represents a billion-plus incremental sales layer to our business — we’re a $12 billion system today, so a 10% mix would be $1.2 billion.”

Meanwhile, Penegor claims that by 2025, 8,000 Wendy’s outlets will have opened around the world. That would be a significant increase from the existing 7,000 or so.

GIPHY App Key not set. Please check settings